Braselton Bank Blends Traditional and Modern Design

Many in the community got their first chance to step inside and explore our thoughtfully designed Peach State Braselton Bank during our grand opening this summer.

Hundreds of customers and neighbors attended the opening of our new 10,000-square-foot building, which features an architectural design that seamlessly combines tradition and modernity.

The new building maintains the classic feel of the columns and brick that characterize the main headquarters in Gainesville while embracing the vibrant spirit of the Braselton area with its sleek gray exterior and contemporary interior.

Peach State Bank’s building committee took into consideration the surrounding buildings’ designs when making decisions on the look of the bank.

Brick serves as a powerful symbol of strength and stability, mirroring the core values and enduring culture that define Peach State Bank. Its solid nature embodies our commitment to building lasting relationships and fostering resilience in everything we do.

The building’s brick color and texture were deliberately selected to perfectly align with the architectural style of the thriving business community that surrounds it. This choice not only enhances the structure’s visual appeal but also asserts its place within the rapidly growing business corridor.

The Braselton bank’s interior was designed to serve the growing community by elevating the customer experience. The interior boasts a modern, welcoming atmosphere that fosters our personalized banking and exceptional service.

The interior of the new bank features open spaces, modern furnishings, and advanced technology. The layout is intended to facilitate easy access to banking services while providing a comfortable atmosphere.

The lobby layout streamlines our banking process and enhances our innovative “universal banking” concept. Each Braselton customer service team member is trained to handle multiple services, from depositing a check or assisting with online banking to opening a new account.

As the Braselton area continues to thrive, Peach State Bank is proud to be a part of this dynamic community. The bank invites residents to visit the new branch and see firsthand the blend of traditional charm and modern convenience that defines our new location.

We Want to Thank Carroll Daniel and All the Area Contractors for Building Our Braselton Bank

G.P.’s Enterprises

Beckmore

A&A Welding Co.

SteelTech Industries

Gateway Fencing

Best 7 Construction

The Cabinet Place

AAA Commercial Floors

A Plus Construction of Georgia

Ted Quinn Painting

Ellard Plumbing

Freedom Mechanical

M&L Sprinkler

Cain Electric Company

LOCAL WINDOW ON THE ECONOMY

The Dirty Secret Quietly Picking the Economy’s Pocket

President & CEO

Unemployment, interest rates and the stock market are always out front in any discussion of the ups and downs of our economy. However, it’s the rising incidence of cybercrime, an ugly cancer coursing through our financial system, that we all should be watching just as closely.

In Georgia, over $420 million is reported stolen each year through scams perpetrated over the phone and Internet. We may be known as the top state to do business, but apparently it applies to cybercrime, too. Nationally, the FBI reports $16.6 billion in annual losses to cybercrime with Georgia ranking 11th in the country for the number of complaints.

Think about all that money sucked out of our daily lives that could have been better spent on invigorating our economy. More than that, the biggest impact is the toll on our quality of life, particularly when you or a family member are the victim – and sadly, the most frequent targets are the elderly.

In the early days of my banking career, bad checks, forgeries and other paper crimes were the more frequent aggravations in our industry. Bank robberies happened more often in the movies, and we paid security guards to stand watch just in case. Today, the money now spent to protect against technology crimes is staggering in comparison to just a decade ago.

In Hall County, banks annually spend multi-millions of dollars on cybersecurity. It’s now a regular cost of business that hits the bottom line, increasing service fees for customers while dragging down the earnings of shareholders.

At Peach State Bank, we now have five cybersecurity staff members dedicated to monitoring customer accounts around the clock. In addition, we pay for sophisticated security software and outsource an international cybersecurity firm.

All this protection – which has stopped over $2 million in fraud attempts just this year – is required despite the fact that our primary customer base is a familiar one within Hall County. So, you can only imagine the hugely magnified security challenges and costs for national banks across mass markets.

Educate and Protect Yourself

Cyberfraud may not feel like it directly affects you – until it does. It’s very scary to think about, but it’s also relatively easy to protect yourself.

For example, never provide your banking account number or other sensitive information to a stranger on the phone or over an email. A bank, utility company or government agency will never contact you by phone to request payment – and you can always hang up and directly contact the institution to verify. Also, you should monitor your bank and credit card accounts daily for suspicious activity.

The Georgia Attorney General’s Office has an excellent consumer protection guide that outlines the most common and current scams. You can request or download it from their website at consumer.georgia.gov.

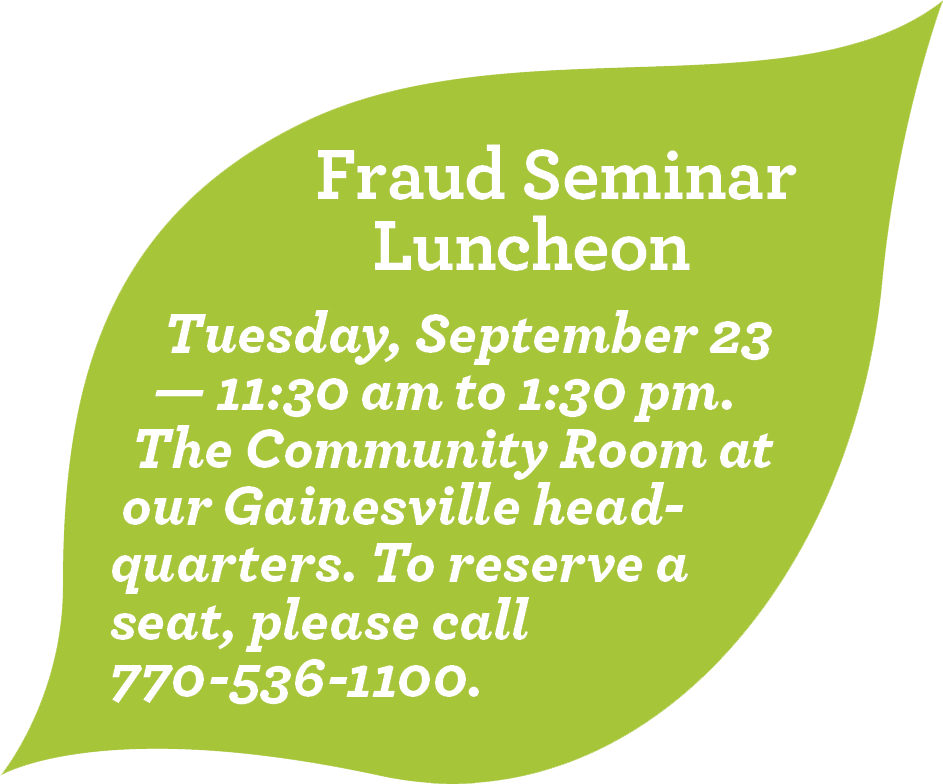

Peach State Bank also conducts free cybersecurity seminars that are hugely popular at local community centers across Hall County. For a schedule or more information, call the bank by phone or check online at peachstate.bank.

Banks and other businesses are doing a much better job these days of detecting and protecting against cyberfraud. But it still requires a partnership with consumers. So, please – do your part and educate yourself to stop this insidious disease from spreading further into our economy, your home or business.

Community News

BLTs, Balloons, and Big Smiles in Braselton

Service News

Switching Direct Deposit to Peach State Just Got a Whole Lot Easier

We’ve got some exciting news to share — Peach State Bank is making it way easier for you to switch your direct deposit over to us. We’ve teamed up with Pinwheel Deposit Switch, a super simple tool that helps you move your paycheck to your Peach State account in just a few clicks. ACH Debit Switch, as well as payroll and deposits, are also available.

No more forms. No more waiting. No more headaches.

Pinwheel offers advantages for both new and existing customers. For new customers, it automates the direct deposit of your payroll check when you open your checking account. For existing customers, it simplifies the direct deposit process if you change jobs and need to switch your payroll provider.

Whether you’re new to Peach State or just ready to make us your go-to bank, Pinwheel makes the process a breeze. We’re all about making banking better — and that means combining our friendly hometown service with tools that save you time and stress. The Pinwheel Deposit Switch is quick and easy, making banking with Peach State even easier.

See us at our Gainesville headquarters or Braselton branch, or visit peachstate.bank to learn more and get started with Pinwheel Deposit Switch today. We are located at 121 E.E. Butler Parkway in Gainesville, and our newest location is at 1502 Friendship Road in Braselton. Peach State representatives will be glad to help you set up your new online banking and add any payees to the system.

Renewing Children’s Lives in the Classroom

One of the best feelings for the staff at the Academy of Innovation in Gainesville is seeing students with dyslexia flourish after years of frustration.

Teachers watch proudly as a student flips through a favorite book with a grin stretching ear to ear — a smile hard-won after years of battling dyslexia. Every day, they’re seeing children transform their lives while offering hope to others facing the same uphill climb.

For nearly 20 years, the Academy of Innovation has been a place where students with learning challenges receive individualized teaching and a chance to improve academically.

“We meet them where they are,” said Carol Henderson, Head of School. “In so many schools, they have to meet whatever the standards are for the school. Here, we are going to take you where you are and go. We are not going to be concerned if you are three or four years behind. It does not matter."

A PROUD SUPPORTER

Peach State has played an active role, much like a proud parent, in nurturing a local program and its evolution into a successful regional enterprise. Our greatest reward is witnessing AOI’s positive impact on the lives of countless children and families in our community.

“We are a longtime customer of Peach State Bank,” Henderson said. “We appreciate the services they offer, and their personal attention has helped us grow to what we are today.”

Founded in 2007 by Ava White, the Academy of Innovation was an outgrowth of White’s successful tutoring program.

“She started a tutorial program and then realized there was a greater need,” said Henderson, who is in her fifth year as head of school. “The kids needed more, and their parents were starting to ask for a full-time school. It was born from that.”

AOI helps students with learning challenges like dyslexia enhance their learning skills, enabling them to thrive in any educational environment. They also teach students with dyscalculia, which affects a person’s ability to understand and use mathematics, and dysgraphia, which affects a student’s ability to write. Many of the students have ADHD or executive function disorder.

“Our primary focus is to teach dyslexic children how to read,” Henderson said. “Some of the other children have neurodivergences. So part of what we are doing is teaching them to read, and the other part is building their confidence.”

Building confidence in the students is a key factor in their ability to learn.

“A large part of what we do is to convince them that they can be successful,” Henderson said. “Eventually, they see they can learn things. They can do things.”

On average, AOI has 35 students from 1st through 12th grade. Though spread out by age, the students have a kindred spirit and bond together. Students take classes like math, science, and social studies, and they take part in extracurricular activities such as physical education, yoga, and art. They also have clubs depending on the students’ interests.

Please join Peach State in supporting the Academy of Innovation. For more information, visit www.aoiga.com.

Online banking offers a convenient way for millions of American households to manage their money. With just a few clicks, customers can check their deposits and pay bills, which saves time and provides them with greater control over their finances.

Banks utilize programs that monitor customer accounts to detect unusual activity, and customers can contribute as well. Here are tips from the American Bankers Association to enhance your online security:

- Use a strong password. Experts advise using a combination of letters, numbers, and characters, and caution you not to use easily guessed passwords, such as birthdays, children’s names, or home addresses. Change your password regularly, and do not use the same password for multiple accounts.

- Keep it to yourself. Don’t share your password or any personal information online with anyone.

- Avoid fraudulent websites. To help ensure the website you have visited is authentic and secure, look for a lock icon on the browser’s status bar or a website URL that begins “https:” when conducting financial transactions online (the “s” stands for “secure”).

- Protect yourself online. Don’t click on pop-ups claiming that your computer is infected or offering discounts, as you may be installing malicious software (“malware”) on your machine.

- Use antispyware. Install and regularly update virus protection software that detects and blocks “spyware” — programs that can give criminals access to your computer.

- Be wary of email. Do not share sensitive information via email. If you receive an unscheduled or unsolicited email claiming to be from your bank, proceed with caution. Close the email and log on to your bank’s online banking yourself, or check with your bank to make sure it’s legitimate.

- Monitor your account. Check your online balances and paper statements frequently to spot any fraudulent activity, and report it immediately to your bank.

- Log off. Remember to sign off of your bank’s secure area when you have finished online banking. Also, log off of your computer to prevent unauthorized access to your information and files.

From the Gym to Banking, a Career Strengthening Lives

Heather Wilbanks, closing in on 20 years at Peach State Bank, ironically started her career in physical fitness and wellness.

Now, as a Peach State Private Banker overseeing multi-million-dollar portfolios, she personally manages the “fiscal fitness” of business owners, doctors, and numerous enterprising individuals and families throughout the region.

Heather is a lender first and foremost, but she and the rest of her team in our private banking department take it a step further. With each new customer, she becomes their personal point of contact, responding 24-7 to their financial challenges while building a lifetime partnership.

Similar to her early role in healthcare, her job allows her to celebrate a lot of “firsts” in people’s lives with their financial goals.

“I love that I’m part of exciting lifetime events like buying a house, starting a business, or investing into a new business,” she said. “It’s a really cool thing to be helping people get ahead and better themselves.”

A DETOUR THAT WORKED OUT

Heather hardly imagined a career in banking after graduating from North Georgia College with a degree in physical education. Her first job entailed coordinating personal exercise and healthy lifestyles at Fit for Life, a wellness center operated by Northeast Georgia Medical Center.

The work was very rewarding, but then came an unexpected curve ball. The growing hospital suddenly announced plans to phase out Fit for Life, leaving Heather without a job.

“My degree was in physical education with an emphasis in wellness, so my career field leaned toward hospital-based wellness facilities,” said Heather, whose options were limited locally. “There just were not a lot of those opportunities, especially since I did not want to commute.”

Fate intervened. Her parents were friends with the president of Southern Heritage Bank in Gainesville and introduced her. The banker obviously saw something in Heather’s potential despite her young age and healthcare background. He immediately hired her, and a lifetime career in banking was born.

“Today, I can’t imagine doing anything else, honestly,” Heather said. “It kind of worked out for me.”

Years later, Heather interviewed for a job at Peach State while on maternity leave with her first child. She was struck by the bank’s family-focused environment. “In my interview, I was assured that I’d never have to miss out on my son’s future school activities.”

Today, Heather and her husband, Matthew, have two sons, Colton and Cooper, who are very athletic.

“The only time I’ve ever missed any of my kids’ ballgames is by choice,” she said. “I’ve always appreciated the freedom to leave work if necessary to take care of my family or be at my family’s special events.”

Heather and her husband still do not miss many of their sons’ ballgames, even though Colton is starting his sophomore year at Motlow State Community College in Tullahoma, Tenn., where he plays basketball. Cooper is a freshman at Chestatee High.

Last year, Cooper had an eighth-grade basketball game at Cherokee Bluff in Flowery Branch at 11 a.m. on a Saturday. After the game, Heather and her husband jumped in their car and drove five hours to Banner Elk, N.C., to see Colton play in a basketball game against Lees-McRae College.

Yes, Heather is equally busy at work — and her dedication to family and customers is what makes her such a valuable and beloved member of the Peach State team.